Strategic Partnerships for Strength: Bagley Risk Management

Strategic Partnerships for Strength: Bagley Risk Management

Blog Article

Exactly How Livestock Risk Protection (LRP) Insurance Coverage Can Protect Your Livestock Financial Investment

In the world of animals financial investments, mitigating threats is critical to making certain financial stability and growth. Animals Threat Protection (LRP) insurance policy stands as a reputable guard against the uncertain nature of the market, providing a critical approach to securing your assets. By diving into the ins and outs of LRP insurance coverage and its complex advantages, animals producers can fortify their financial investments with a layer of protection that transcends market variations. As we discover the world of LRP insurance coverage, its duty in securing animals investments ends up being significantly noticeable, assuring a path in the direction of lasting economic durability in a volatile industry.

Understanding Animals Risk Security (LRP) Insurance

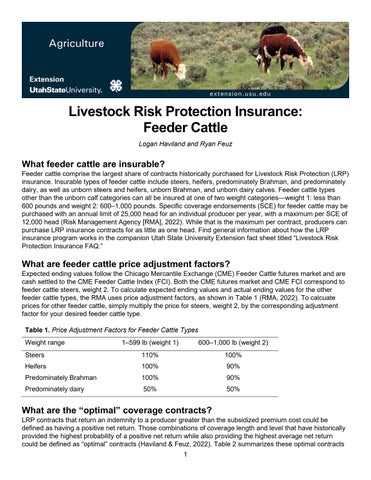

Understanding Animals Threat Defense (LRP) Insurance coverage is essential for animals producers aiming to mitigate monetary dangers connected with cost changes. LRP is a federally subsidized insurance policy item made to safeguard manufacturers versus a decrease in market value. By supplying insurance coverage for market price decreases, LRP aids manufacturers lock in a flooring rate for their animals, guaranteeing a minimum degree of revenue despite market variations.

One trick aspect of LRP is its flexibility, permitting manufacturers to personalize coverage levels and policy lengths to suit their certain needs. Manufacturers can choose the variety of head, weight array, protection rate, and protection duration that line up with their manufacturing goals and run the risk of resistance. Understanding these personalized options is critical for manufacturers to efficiently handle their cost danger direct exposure.

Moreover, LRP is offered for various animals kinds, including cattle, swine, and lamb, making it a versatile danger administration tool for animals manufacturers throughout various markets. Bagley Risk Management. By familiarizing themselves with the complexities of LRP, producers can make informed choices to protect their investments and guarantee financial security when faced with market unpredictabilities

Benefits of LRP Insurance for Livestock Producers

Livestock producers leveraging Animals Risk Protection (LRP) Insurance coverage obtain a tactical advantage in protecting their investments from cost volatility and protecting a stable economic ground among market unpredictabilities. One key benefit of LRP Insurance is rate protection. By establishing a flooring on the cost of their livestock, producers can alleviate the risk of significant monetary losses in the event of market declines. This allows them to prepare their budgets better and make informed choices regarding their procedures without the constant fear of rate variations.

Furthermore, LRP Insurance coverage provides manufacturers with assurance. Recognizing that their investments are guarded against unexpected market adjustments permits producers to concentrate on various other aspects of their service, such as enhancing pet health and welfare or enhancing manufacturing processes. This comfort can lead to enhanced efficiency and success over time, as manufacturers can operate with even more confidence and stability. In general, the benefits of LRP Insurance for animals manufacturers are considerable, using a useful device for managing threat and making sure monetary security in an unforeseeable market atmosphere.

Just How LRP Insurance Mitigates Market Dangers

Mitigating market threats, Livestock Risk Security (LRP) Insurance coverage provides livestock manufacturers with a dependable guard versus cost volatility and financial unpredictabilities. By offering security versus unanticipated cost declines, LRP Insurance policy helps manufacturers protect their financial investments and preserve economic security when faced with market changes. This sort of insurance enables animals producers to secure a rate for their animals at the beginning of the policy duration, making sure a minimum cost degree no matter of market modifications.

Actions to Safeguard Your Animals Financial Investment With LRP

In the world of farming threat administration, applying Livestock Risk Defense (LRP) Insurance includes a critical procedure to protect financial investments versus market fluctuations and uncertainties. To secure your animals investment effectively with LRP, the very first step is to examine the particular dangers your procedure faces, such as price volatility or unanticipated weather events. Comprehending these dangers allows you to figure out the insurance coverage level needed to shield your financial investment appropriately. Next off, it is essential to research study and choose a reliable insurance service provider that supplies LRP plans customized to navigate here your livestock and organization needs. As soon as you have actually chosen a supplier, meticulously examine click to read the plan terms, problems, and coverage limits to ensure they align with your threat management objectives. In addition, frequently monitoring market fads and readjusting your coverage as required can help maximize your protection against possible losses. By complying with these actions diligently, you can boost the safety of your animals financial investment and browse market uncertainties with self-confidence.

Long-Term Financial Security With LRP Insurance Policy

Making sure withstanding economic security through the application of Animals Threat Defense (LRP) Insurance coverage is a sensible long-term strategy for agricultural producers. By including LRP Insurance coverage right into their danger administration plans, farmers can guard their livestock investments versus unexpected market changes and unfavorable occasions that might endanger their financial well-being in time.

One secret advantage of LRP Insurance for long-term financial security is the satisfaction it provides. With a dependable insurance plan in position, farmers can reduce the monetary dangers related to volatile market conditions and unforeseen losses as a result of variables such as disease episodes or all-natural disasters - Bagley Risk Management. This security permits manufacturers to concentrate on the daily procedures of their livestock organization without constant fret about prospective financial setbacks

Moreover, LRP Insurance offers a structured technique to taking care of threat over the long term. By establishing particular coverage levels and picking proper recommendation periods, farmers can customize their insurance plans to straighten with their economic objectives and run the risk of tolerance, guaranteeing a safe and secure and sustainable future for their animals procedures. To conclude, buying LRP Insurance is an aggressive method for agricultural producers to attain enduring monetary safety and shield their resources.

Verdict

Finally, Animals Risk Defense (LRP) Insurance coverage is why not check here a beneficial tool for livestock producers to minimize market risks and secure their investments. By comprehending the benefits of LRP insurance and taking steps to execute it, producers can achieve long-lasting financial safety for their operations. LRP insurance offers a safeguard versus rate fluctuations and makes sure a level of stability in an uncertain market atmosphere. It is a smart choice for guarding livestock investments.

Report this page